The ordinary meaning of ‘Remuneration‘ is an amount of money that is paid to somebody for the work they have done; reward; compensation.

As per Section 2(78) of the companies Act, 2013 ‘Remuneration’ defined as any money or its equivalent given or passed to any person for services rendered by him and includes perquisites as defined under income tax Act, 1961.

Accordingly, any money paid in any form or by any name to a director for services rendered by him will amount to ‘remuneration’ and any benefit provided by company to a director will amount to ‘remuneration and monetary equivalent will have to be included in remuneration of the directors.

Remuneration Payable by Company to its Director

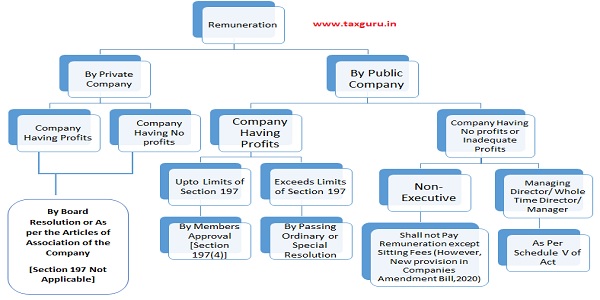

Remuneration Payable by Private Company:

As per the provisions of Companies Act, 2013, the restriction under Section 197 and Section 198 shall apply only when managerial remuneration or remuneration paid by a public Company. Hence, any remuneration paid or payable by a private company to its director shall be out of purview of the above said section and shall not be counted for the purpose of maximum remuneration payable by the company.

Upper Limits Fixed on Remuneration (In case of Public Company)

As per Section 197 of the Act, the total managerial remuneration payable by a public company, to its directors, including managing director, whole time director and its manager, in respect of any financial year shall not exceed 11% of the net profits of that company.

Accordingly, a public company can pay remuneration to its directors including executive directors and non-executive directors within the limits of 11% of the net profits and this limits can only be exceeded with the prior approval of the members of the company by an ordinary resolution. [First proviso to Section 197(1)]

The remuneration payable to a director shall be inclusive of the remuneration payable to him for the services rendered by him in any other capacity. [Section 197(4)]

This means that even if a director is paid remuneration for special services apart from directorial services, then such amount must also be included in the total remuneration in order to ascertain the limits of 11% of net profits as prescribed under Section 197(1) of the Act.

However, the only exceptionis when remuneration paid for professional services rendered by a director to the company without any limit is not included in the limit, if the following two conditions are satisfied:

Remuneration to Executive Directors

In Case Company has Adequate Profits:

According to second proviso to section 197(1)(i) of the Act, except with the approval of the company in general meeting, the remuneration payable to any one managing director; or whole time director or manager shall not exceed 5% of the net profits of the company and if there is more than one such director remuneration shall not exceed 10% of the net profits to all such directors and manager taken together. However, in case of these limits can be paid with the approval of the members of the company by passing a special resolution and prior approval of any bank or public financial institution or non-convertible debenture holders or any other secured creditor is also required in case of defaulting company, but subject to the upper limit of 11%.

Part II of Schedule V of the Act, also contains provisions regarding remuneration payable to managing director and whole time director and its Section I states that:

“Subject to the provisions of Section 197, a company having profits in a financial year may pay remuneration to a managerial person or persons not exceeding the limits specified in such section.”

Thus, a managing director and whole time director can be paid upto 5% or 10% of net profits as remuneration for any financial year, in any manner, such as salary, allowances, perquisites, other benefits etc., but the aggregate value of all such components of remuneration must not exceed the above said limits.

Remuneration in case of Company has no or inadequate profits

If, in any financial year, a company has no profits or its profits are inadequate to pay the remuneration fixed by the board, the company can not pay to its directors (including any managing or whole time director or manager) remuneration except in accordance with the provisions of schedule V of the Act. [Section 197(3)]

Section II Part II of Schedule V, also states that where in any financial year during the tenure of a managerial person, a company has no profits or its its profits are inadequate, it may, pay remuneration to the managerial person not exceeding, the limits under (A) and (B) given below:-

(A):

| (1) | (2) |

| Where the effective capital is | Limit of yearly remuneration payable shall not exceed (Rupees) |

| (i) Negative or less than 5 crores | 60 Lakhs |

| (ii) 5 crores and above but less than 100 crores | 84 Lakhs |

| (iii) 100 crores and above but less than 250 crores | 120 Lakhs |

| (iv) 250 crores and above | 120 lakhs plus 0.01% of the effective capital in excess of Rs. 250 crores: |

Provided that the remuneration in excess of above Iimits may be paid if the resolution passed by the shareholders is a special resolution.

Explanation:- It is hereby clarified that for a period less than one year, the limits shall be pro-rated.

(B) In case of a managerial person who is functioning in a professional capacity, remuneration as per item (A) may be paid, if such managerial person is not having any interest in the capital of the company or its holding company or any of its subsidiaries directly or indirectly or through any other statutory structures and not having any, direct or indirect interest or related to the directors or promoters of the company or its holding company or any of its subsidiaries at any time during the last two years before or on or after the date of appointment and possesses graduate level qualification with expertise and specialised knowledge in the field in which the company operates:

Provided that any employee of a company holding shares of the company not exceeding 0.5% of its paid up share capital under any scheme formulated for allotment of shares to such employees including Employees Stock Option Plan or by way of qualification shall be deemed to be a person not having any interest in the capital of the company;

Provided further that the limits specified under items (A) and (B) of this section shall apply, if-

(i) Payment of remuneration is approved by a resolution passed by the Board and, in the case of a company covered under sub-section (1) of suction 178 also by the Nomination and Remuneration Committee;

(ii) the company has not committed any default in payment of dues to any bank or public financial institution or non-convertible debenture holders or any other secured creditor, and in case of default, the prior approval of the bank or public financial institution concerned or the non-convertible debenture holders or other secured creditor, as the case may be, shall be obtained by the company before obtaining the approval in the general meeting.

(iii) an ordinary resolution or a special resolution, as the case may be, has been passed for payment of remuneration as per item (A) or a special resolution has been passed for payment of remuneration as per item (B), at the general meeting of the company for a period not exceeding three years.

(iv) a statement along with a notice calling the general meeting referred to in clause (iii) is given to the shareholders containing the information as provided in Schedule V.

Remuneration to Non-Executive Directors (Including Independent Director)

In case Company Have enough Profits

As per the second proviso to Section 197(1) of the Act, Company may pay remuneration to Non-Executive Directors (Including Independent Directors) within the following Limits:

And the above said limits are exceeds by the company with prior approval of members by special resolution and and prior approval of any bank or public financial institution or non-convertible debenture holders or any other secured creditor is also required in case of defaulting company.

Moreover, as per the provisions of Section 149(9), an independent director shall not be entitled to any stock option and may receive remuneration by way of fee provided under sub-section (5) of section 197, reimbursement of expenses for participation in the Board and other meetings and profit related commission as may be approved by the members.

In Case Company Has No profits or Inadequate Profits

As per the provisions of Section 197(5) read with Schedule V of the Act, if company has no profits in any financial year,only managerial personnel are entitled to remuneration. Hence, it cannot pay remuneration to its non-executive directors (Including Independent Director) except the sitting fees.

However as per Companies Amendment Bill, 2020 , it is proposed to insert a new proviso in section 149(9) and amend section 197(3), which provides that non-executive directors (Including independent director) may receive remuneration, if a company has no profits or inadequate profits in accordance with Schedule V of the Act, by aligning the same with the provisions for remuneration to executive directors in such cases.

SEBI (LODR) Regulations for Non-executive Directors

Regulation 17(6) of the SEBI (LODR) Regulations, 2015 provides that—

> The board of directors shall recommend all fees or compensation, if any, paid to non-executive directors, including independent directors and shall require approval of shareholders in general meeting.

> The requirement of obtaining approval of shareholders in general meeting shall not apply to payment of sitting fees to non-executive directors, if made within the limits prescribed under the Companies Act, 2013 for payment of sitting fees without approval of the Central Government.

> The approval of shareholders mentioned in clause (a), shall specify the limits for the maximum number of stock options that may be granted to non-executive directors, in any financial year and in aggregate.

> The approval of shareholders by special resolution shall be obtained every year, in which the annual remuneration payable to a single non-executive director exceeds fifty per cent of the total annual remuneration payable to all non-executive directors, giving details of the remuneration thereof.

> Independent directors shall not be entitled to any stock option.

> The fees or compensation payable to executive directors who are promoters or members of the promoter group, shall be subject to the approval of the shareholders by special resolution in general meeting, if-

I. The annual remuneration payable to such executive director exceeds rupees 5 crore or 2.5 per cent of the net profits of the listed entity, whichever is higher; or

II. where there is more than one such director, the aggregate annual remuneration to such directors exceeds 5 per cent of the net profits of the listed entity:

> Provided that the approval of the shareholders under this provision shall be valid only till the expiry of the term of such director.

Sitting Fees

Section 197(5) of the Act, provides that a director may receive remuneration by way of fees for attending meetings of the board or committee thereof or for any other purpose whatsoever as may be decided by the board, but the amount of such fees shall not exceed the amount as may be prescribed.

Rule 4 of the Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014 further provides that an amount of sitting fees shall not exceed one lakh per meeting of the board or committee thereof.

Thus, all directors are eligible to be paid sitting fee with the limit of Rule 4, however the executive directors are usually not paid sitting fees. The fees can be paid for meetings of all the committees of directors even if any committee has been constituted without a legal requirement, But fee can paid only when a meeting is actually held.

Excess remuneration, if any, drawn by a director shall be refundable to the company

As per the Section 197(9) as amended by the Companies (Amendment) Act, 2017, if any director draws or receives, directly or indirectly, by way of remuneration any such sums in excess of the limit prescribed by section 197(1) or without approval required under this section, he shall refund such sums to the company, within two years or such lesser period as may be allowed by the company, and until such sum is refunded, hold it in trust for the company.

Excess remuneration recoverable can be waived by the company

Section 197(10) as amended by the Companies (Amendment) Act, 2017, States that the company shall not waive the recovery of any excess remuneration paid and refundable to it under Section 197(9) unless approved by the company by special resolution within two years from the date the sum becomes refundable.

Moreover, where any term loan of any bank or public financial institution is subsisting or the company has defaulted in payment of dues to non-convertible debenture holders or any other secured creditor, the prior approval of the bank or public financial institution concerned or the non-convertible debenture holders or other secured creditor, as the case may be, shall be obtained by the company before obtaining approval of such waiver.

Payment of premium of insurance for the Directors and KMP for indemnifying any of them against any liability in respect of any negligence, default, etc. shall not be counted or treated as part of the managerial remuneration

As per the provisions of Section 197(13), where any insurance is taken by a company on behalf of its managing director, whole-time director, manager, Chief Executive Officer, Chief Financial Officer or Company Secretary for indemnifying any of them against any liability in respect of any negligence, default, misfeasance, breach of duty or breach of trust for which they may be guilty in relation to the company, the premium paid on such insurance shall not be treated as part of the remuneration payable to any such personnel.

However, if such person is proved to be guilty, the premium paid on such insurance shall be treated as part of the remuneration.

Remuneration paid to the Company Secretary and Chief Financial Officer being the Key Managerial is not a managerial remuneration

Any remuneration paid or payable by a public company to its company secretary or chief financial officer although they are categorized as key managerial persons, even though the restriction under sections 197 and 198 regarding managerial remuneration or remuneration paid by a public company to them shall be out of the purview of the above said section and shall not be counted for the purpose of maximum remuneration payable by the company.

Disclosures Requirements

Schedule V of the SEBI (LODR) Regulations, 2015 provides that:

> All pecuniary relationship or transactions of the non-executive directors vis-à-vis the listed entity shall be disclosed in the annual report;

> Criteria of making payments to non-executive directors, alternatively, this may be disseminated on the listed entity’s website and reference drawn thereto in the annual report;

> Disclosures with respect to remuneration: in addition to disclosures required under the Companies Act, 2013, the following disclosures shall be made:

I. All elements of remuneration package of individual directors summarized under major groups, such as salary, benefits, bonuses, stock options, pension etc;

II. Details of fixed component and performance linked incentives, along with the performance criteria;

III. Service contracts, notice period, severance fees;

IV. Stock option details, if any and whether issued at a discount as well as the period over which accrued and over which exercisable.

Under Companies Act, 2013

> Section 197(16) Inserted by The Companies (Amendment) Act, 2017, provides that The auditor of the company shall, in his report under section 143, make a statement as to whether the remuneration paid by the company to its directors is in accordance with the provisions of this section, whether remuneration paid to any director is in excess of the limit laid down under this section and give such other details as may be prescribed.

> Section 197(12) also provides that every listed company shall disclose in the Board’s report, the ratio of theremuneration of each director to the median employee’s remuneration and Rule 5(1) ofthe Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014 also provides certain information which are required to be disclosed by every listed company in its Board’s Report.

Taxability of Remuneration

Goods and Service Tax (GST)

As per Schedule III of The Central Goods and Services Act, 2017 (CGST Act), any services by an employee to the employer in the course of or in relation to his employment will not be considered as supply of goods or services.

Further, as per the provisions of Companies Act, 2013 Executive Directors means Whole Time Director and Section2(94) defines “Whole Time Director” as director in the whole-time employment of the Company. Thus, Executive Directors are directors who are whole time employee of the Company.Whereas, non–executive directors are not the employee of the Company.

Thus any services provided by Executive Directors will be covered under schedule III and will not be considered as supply of goods or services. However, any payment made to non-executive directors will be chargeable to GST under reverse charge mechanism.

Income Tax Act, 1961

As per Section 16 read with Section 192 of Income Tax Act, 1961, all directors remuneration are treated as Salary and will be taxable under the head “Salary” and Company is required to deduct TDS except the sitting fees.

Further, as per the provisions of Section 194J of the Income Tax Act, 1961, Sitting fees which are given by company to its directors will be treated as professional fees and company is required to deduct TDS @10%.

Relevant Sections, Rules and Regulations of above

| Particulars | Sections, Rules, Regulations |

| 1.The Companies Act, 2013 | Section 197, 198, 199, 200, 149 and Schedule V |

| 2. The Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014 | Rule 4, 5,6 and 7 |

| 3. SEBI (LISTING OBLIGATIONS AND DISCLOSURE REQUIREMENTS) REGULATIONS, 2015 | Regulation 17(6) and Schedule V |

| 4. Companies Amendment Bill, 2020 | |

| 5. The Central Goods and Services Act, 2017 (CGST Act) | Schedule III |

| 6. Income Tax Act, 1961 | Section 16, 192 and 194J |