A tax clearance certificate is issued by the Department of Taxation to certify that the taxpayer named on the certificate is compliant with the tax laws of Hawaii (Title 14, Hawaii Revised Statutes). This means the taxpayer has filed all required tax returns and paid or has an active payment plan to settle all liabilities (including fees, penalties, and interest) due as of the date the certificate is issued.

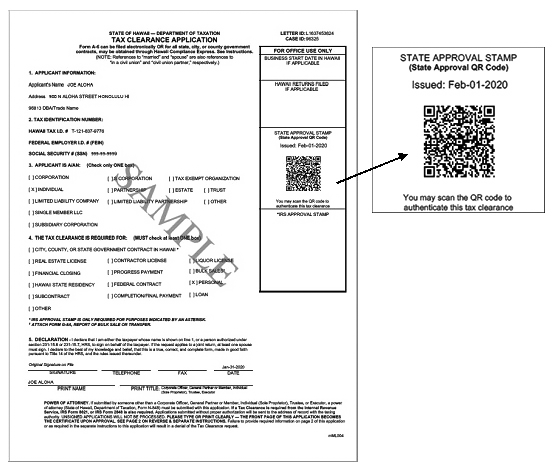

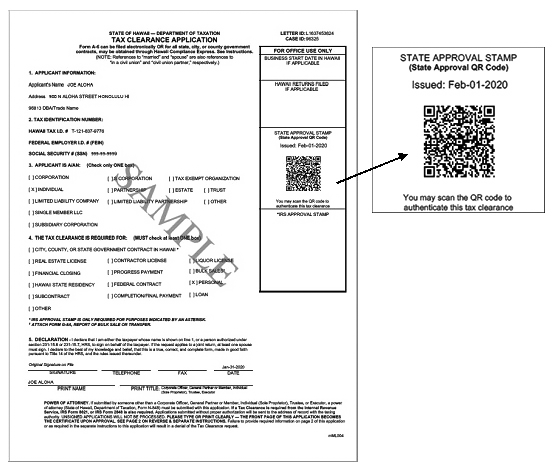

Tax clearance certificates issued prior to September 3, 2019, will have a green stamp with a signature. Tax clearance certificates issued after September 3, 2019, will have a scannable QR code that can be validated. This enables tax clearance certificates to be processed electronically and printed by the taxpayer. The QR code can be scanned using a web enabled device, such as a smart phone, to confirm authenticity and validity. A tax clearance certificate may be revoked by the Department when the taxpayer falls out of tax compliance.

After signing in to your Hawaii Tax Online account, navigate to “I Want To” then to “Request a Tax Clearance Certificate” under “Tax Clearance.” You can also download and print the tax clearance application, Form A-6, and submit in person, by fax, or by mail. Mailing addresses and contact information are provided on page 2 of the application.

For vendors with contracts of $2,500 or more with the State or county government, the Certificate of Vendor Compliance satisfies the proof of compliance requirements. See Tax Facts 31-2 to learn more about tax clearance requirements for businesses and nonprofit organizations that plan on entering into a contract with the State of Hawaii or its counties. For all others, please check with the entity requesting the tax clearance certificate whether they will accept a Certificate of Vendor Compliance in lieu of a tax clearance certificate.

The tax clearance certificate does not have a “valid period” or “expiration date.” Partners requiring the tax clearance certificate set their own rules regarding date of issuance.

No. Currently, there is no fee to submit an application for a tax clearance certificate.

The individual taxpayer, a corporate officer, general partner or member, trustee or executor or an authorized agent with a valid Power of Attorney, Form N-848, may apply for a tax clearance. A tax clearance review can also be initialized by the Department of Taxation or a partner agency (e.g., Hawaii Compliance Express).

Yes, if the full debt is in a valid payment plan, you will be considered compliant and will be issued a tax clearance certificate. If the payment plan is broken, the Department of Taxation reserves the right to invalidate the tax clearance certificate issued.

In most cases, requests on Hawaii Tax Online are processed within one day. A paper Form A-6 may take 10 to 15 business days.

Sign in to your Hawaii Tax Online account to view information about your tax accounts (navigate to “I Want To” then to “Manage Payments and Returns”). The tax clearance denial letter also provides you with any returns that need to be filed or outstanding liabilities that need to be paid. Once all of the returns are filed and payments made, submit a new tax clearance application.

If this notification was issued on a weekend or holiday, please check your compliance status on the next business day. If it was not received on a weekend or holiday, you can view information regarding your tax accounts on Hawaii Tax Online. Please refer to question regarding checking tax compliance status below.

Yes. Sign in to your Hawaii Tax Online account, navigate to “I Want To” then to “Tax Compliance Status” under “Tax Clearance.” If your status is “Compliant,” a tax clearance certificate would be issued if you applied for one. If your status if “Non-Compliant,” return to the home screen and navigate to “I Want To” then to “Manage Payments and Returns” for the list of returns and payments that must be submitted before a tax clearance certificate would be issued.

The Department of Taxation may enter into data sharing agreements to provide the tax clearance status to authorized government agencies or its vendors. It will not share details as to why the entity is not tax compliant.

PLEASE NOTE: (For DCCA Contractors Renewals) A Tax Clearance status with DCCA as a signatory is an acceptable and approved form of the Department of Taxation. If you need a Tax Clearance with you as the signatory, you can also request a one via HTO or by submitting the Form A-6.

For more FAQs, see: